Image: Money / Getty Images

Image: Money / Getty ImagesHirsch Leatherwood

Price Tags

Plus: Joey Chestnut and Anna Delvey

Happy Monday! For this edition of Out of Scope, we dive into America’s ongoing pricing crisis. But first, here are stories from last week with some staying power...

📡ON OUR RADAR

En vogue in corporate America: proficiency in pitch n' putt. Per the Wall Street Journal, golf is becoming an increasingly sought-after skill for prospective job seekers. In other words, your friends who won’t shut up about the Masters finally have a chance to be the personality hire.

Joey Chestnut has won Nathan’s hot dog eating contest 8 years in a row. That streak is now in jeopardy, as Chestnut may not be invited to compete this year since he signed a deal with Nathan’s indirect competitor, Impossible Foods. Netflix was quick to swoop in with its own contest as it looks to build its sports streaming business.

Sony has purchased the cinephile-favorite movie theater chain Alamo Draft House, a blow for antitrust advocates and the film bro in your life. Welcome back, United States v. Paramount Pictures, Inc.!

💡ON OUR MINDS: Price Tags

Turns out your $13.93 burrito is priced strategically—and nothing is sacred. The recent surge in inflation over the past several years has sparked national interest in how leading companies set their prices.

Excellent reporting from The American Prospect reveals how companies are adopting sophisticated economic strategies. They use personalized data and algorithms to gauge the maximum price consumers are willing to pay for their products.

During and immediately after the COVID-19 pandemic, corporations across the United States widened their profit margins, taking advantage of increased consumer spending power. These days, as conditions return to an equilibrium, companies are looking to see just how much they can charge before ick-ing out shoppers.

Call it the Uber model or the teachings of the airline industry, where there are no set prices but rather just a cesspool of competing factors that inform how much something might be for someone at some point in time.

As this summer’s “vibecession” continues, an explanation of this pricing phenomenon offers some clarity to weary consumers and confused talking heads looking to understand why our day-to-day just feels… off.

🥊QUICK HITS:

In case you missed these reads:

Anna Delvey’s old building at 281 Park is becoming a tough sell despite its long history associated with trustworthiness and being a wise investment-ness.

In what could prove to be a landmark case for the guy who gets too sloshed at company happy hours, NBCUniversal argues that exorbitant boozing on the clock is protected by the very constitution on which this great country was built.

BeReal—the app most popular at the height of the pandemic designed to make social media feel more authentic—is being acquired by mobile apps and games company Voodoo for €500M.

Thanks for reading,

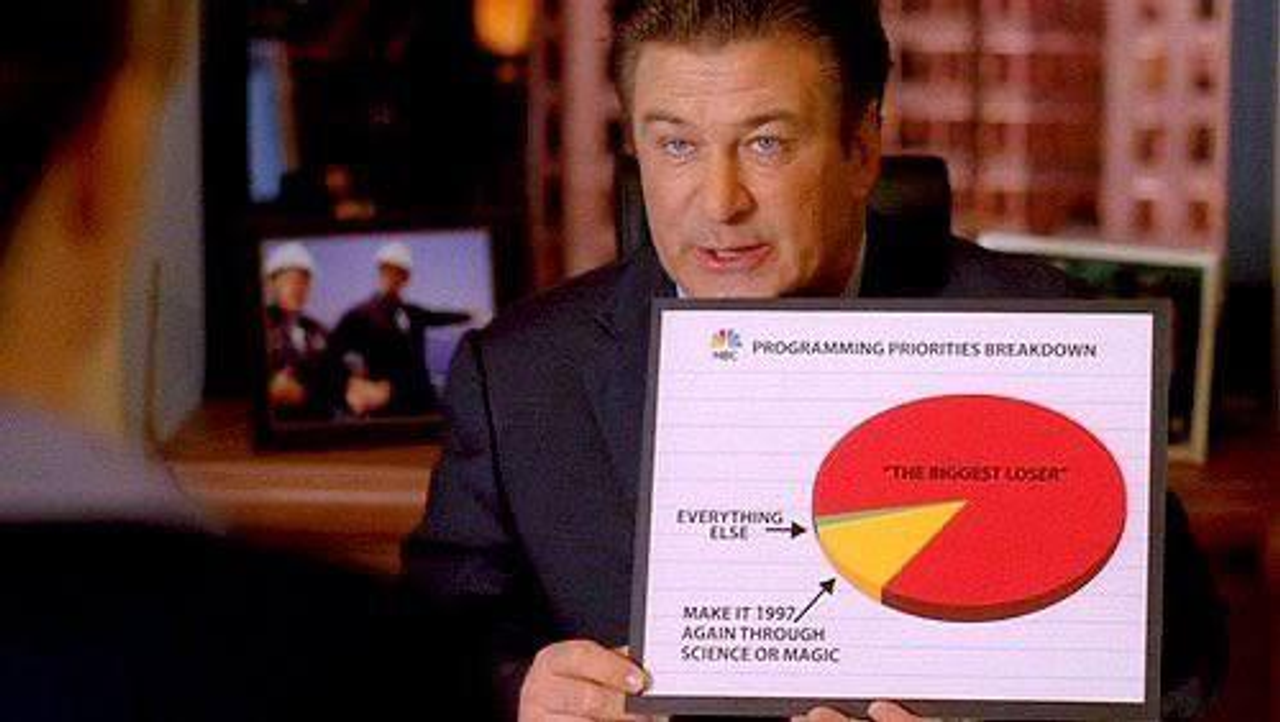

HLThis week’s newsletter is brought to you by the surprising resurgence of The A.V. Club, and making it 2010 again through science or magic.